Graduate PLUS Loan

Beginning 2024-2025 applications for PLUS loans will be completed through StudentAid.gov. The 2025-2026 application will be available in April. All Summer 2025 PLUS Loans should be requested through StudentAid.gov.

In an effort to provide better understanding about the credit-based PLUS Loan, please review the following counseling steps:

- Complete the FAFSA, if you have not already done so. This allows SFS to award you any eligible, non credit-based financial aid before utilizing credit-based products

- Review the Graduate PLUS Loan interest rate, repayment terms, credit criteria, etc

- Review the Cost of Attendance for your program, to determine how much you can, and need to borrow

- Compare other private, credit-based loan products, against the terms of the Graduate PLUS Loan. On the linked page, click on your school to provide more loan options.

- Review your current federal aggregate loan debt by logging into StudentAid.gov. Be advised that federal loans disbursed 30 days or less from today’s date may not have yet to post on the site.

- If you are a new borrower please complete the Federal Student Aid Graduate PLUS Loan Promissory Note and Entrance Counseling

Please be advised that it can take 10-15 business days to process your Graduate PLUS Loan, especially during busier times of the year. A PLUS Loan application must be submitted each time a new PLUS loan is requested – SFS cannot apply a PLUS Loan without a valid request form on file and PLUS loans do not renew automatically each academic year.

2025-2026 Graduate PLUS Loan Application Instructions

- Log into studentaid.gov

- Under Loans and Grants dropdown, click on PLUS Loans: Grad PLUS and Parent PLUS

- Select I am a Graduate or Professional Student

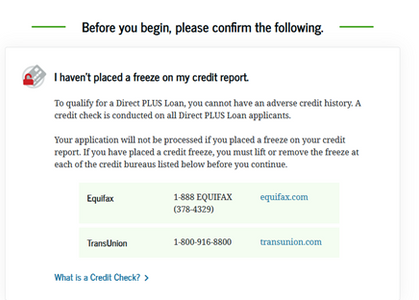

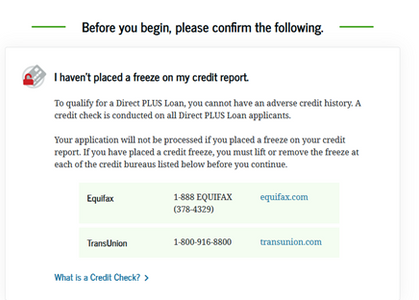

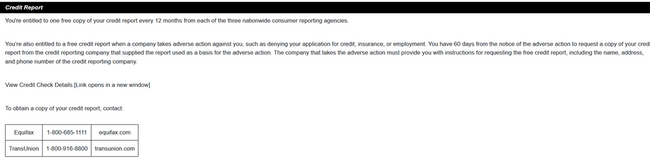

- Review credit report freeze information

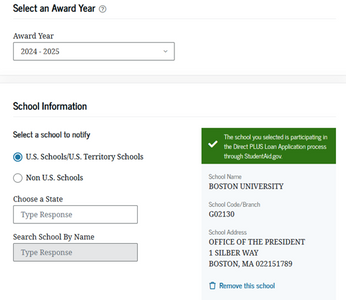

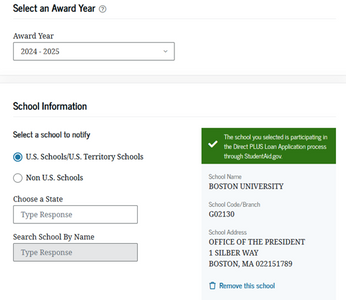

- Select Academic Year 2025-2026

- Choose Boston University under School Information

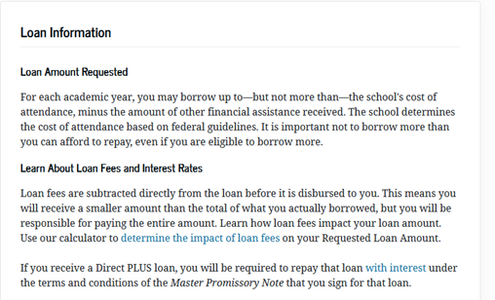

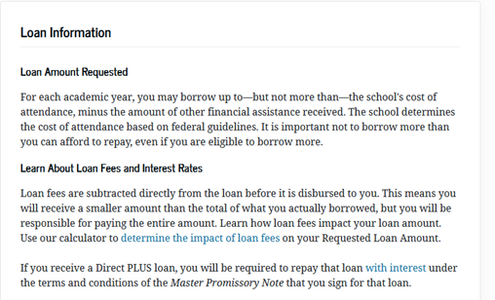

- Complete demographic information, and advance to Loan Information

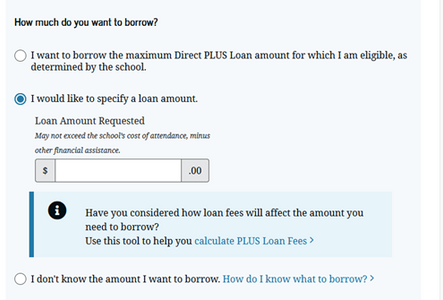

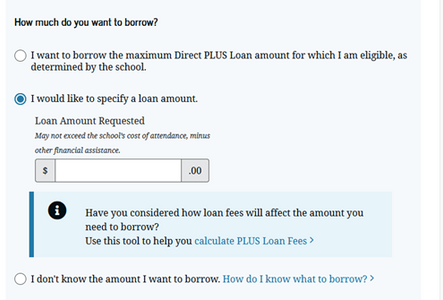

- “Loan Amount Requested” choose three options:

-

- I want to borrow the maximum Direct PLUS (Cost of attendance – BU or external funds = PLUS amount)

- The amount can be reduced at a future date

- I would like to specify a specific loan amount (split evenly between two semesters)

- I don’t know how the amount I want to borrow (you can submit, but may need to resubmit application if you don’t know how much to request)

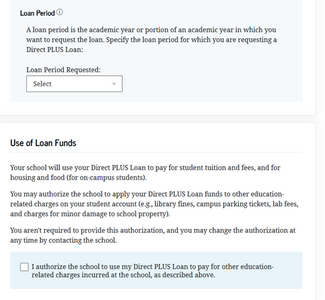

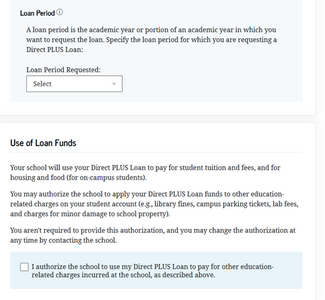

- Select Loan Period “BU Medical Campus 04/2025 – 07/2026”

- If requesting a loan for only one semester, select “Other”

- Review Use of Loan Funds authorization

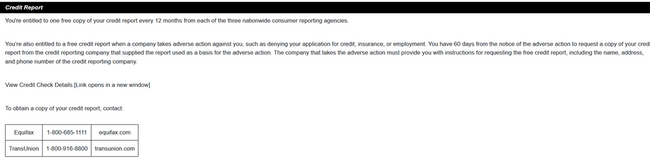

- Review Credit Check disclosure, Important Notices, and Certifications and Authorizations

- Review all information and verify the application data accuracy

- Click Submit

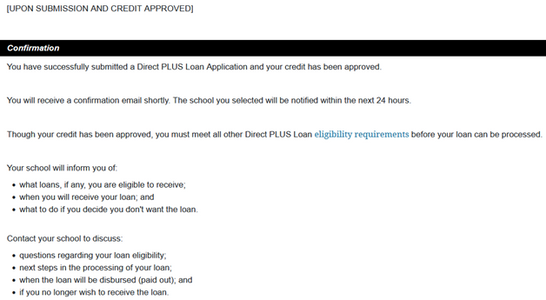

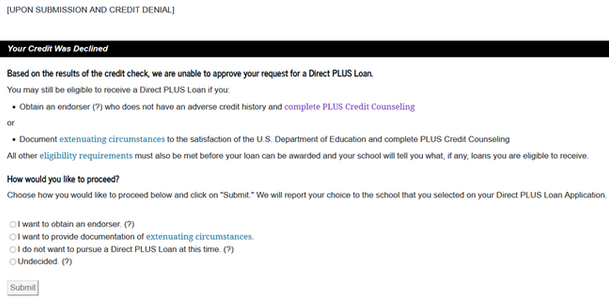

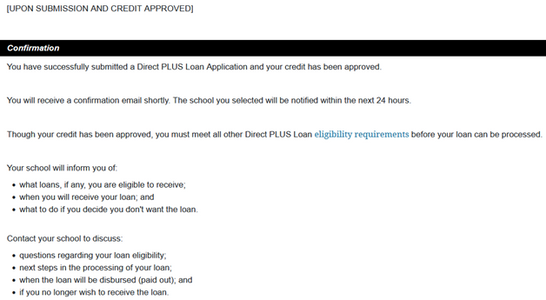

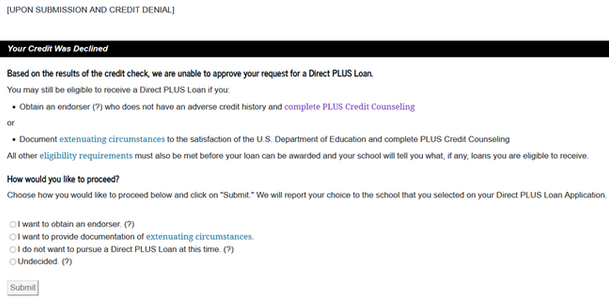

Credit decision will come immediately (see messaging below)

Credit approval messaging

Credit denial messaging

Credit pending messaging

What next?

Your application will be transmitted from studentaid.gov to Boston University. It may still take some time to apply to your MyBU Student Account. However, if you received a PLUS loan credit approval, your PLUS application will be processed, and applied to your account.

Federal Financial Aid Credit Authorization (FFACA)

Federal regulations require that federal financial aid credited to your student account be applied only to cover allowable charges, unless Boston University obtains authorization to apply these funds to all other charges on your student account. You may submit your authorization electronically on the MyBU Student Portal under “Financials > Permissions.”

Without your authorization, Title IV funds credited to your student account cannot be applied to non-allowable charges.

This may result in a refund being automatically issued to you that creates a balance due on your account. The resulting student account balance becomes your responsibility to repay.

Title IV Federal Financial Aid Funds

- Federal Direct Loans

- Graduate PLUS Loans

Allowable Charges

Non-Allowable Charges (include but are not limited to)

- MBTA Pass

- Medical insurance

- Replacement ID fees

- University Health Services fees for service

- Other miscellaneous fees

Graduate PLUS Loan FAQs

What requirements do I need to submit to be approved for the PLUS loan?

Please complete the Graduate PLUS Master Promissory Note, Graduate Entrance Counseling. Those with adverse credit who appeal the credit decision or utilize an endorser will be required to complete PLUS loan Credit Counseling.

If you completed the MPN and Entrance Counseling before, and received the PLUS loan in the last academic year, you do not need to submit a MPN and Entrance Counseling again.

How do I request a PLUS loan for a single semester?

When applying at studentaid.gov, chose the “Other” Loan Period.

What is the maximum amount I can borrow?

When applying at studentaid.gov, under the “How much do you want to borrow?”, select the “I want to borrow the maximum Direct PLUS loan for which I am eligible, as determined by my school.

Per federal regulations, students may receive a maximum in total financial aid (all sources) up to their annual cost of attendance. You can use the COA Calculator to determine the maximum amount of PLUS loan you may request and receive.

I want to cover my health insurance (SHIP) with the PLUS Loan. Do I still need to submit a second application?

It depends. If the SHIP has been charged to your account, the PLUS funding should account for the SHIP expenses. However, if there is a change in your SHIP charges, you may need to submit a second application AFTER the first PLUS application has been applied to your MyBU Student account.

I was credit denied/credit pending. What are the next steps?

Please follow the steps provided after your credit decision to determine what you need to do in order to have the PLUS loan credit to your account.