Federal Student Loans

Federal Unsubsidized Direct Loans

Federal Unsubsidized Direct Loans are federally supported, low-interest student loans with flexible repayment options.

An applicant/student must be a U.S. citizen, a naturalized citizen of the United States, permanent resident or an eligible non-citizen. All applicants must submit the Free Application for Federal Student Aid (FAFSA) for determination of Direct Loan eligibility. Students must also complete Entrance Counseling and the Master Promissory Note before the INITIAL disbursement of a Federal Direct Loan Loan can be made.

More detailed information about interest rate, fees, and loan terms can be obtained at the U.S. Department of Education Student Aid website.

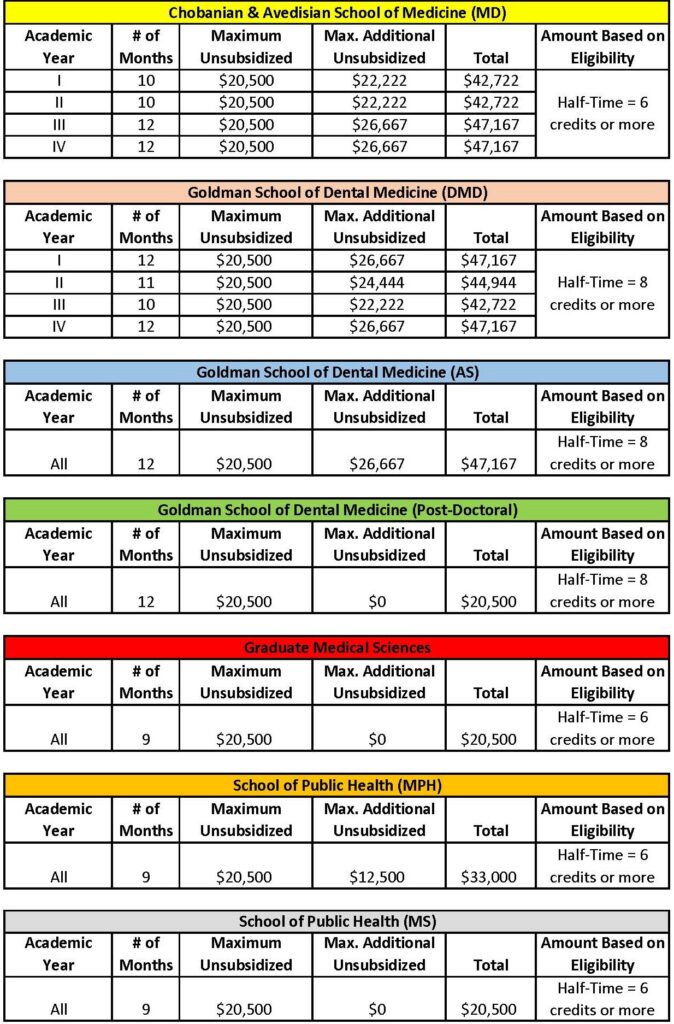

Annual Federal Unsubsidized Loan Limits

The below charts details the annual maximum limit for the Unsubsidized Direct Loan for the 2024-2025 academic year, based off the enrolled program, as well as the academic year.

Incoming students: if you submitted a FAFSA, and a complete financial aid application, you will be awarded the annual maximum for your school of enrollment. Please contact our office via email to reduce, or cancel awarded federal loans. Provide your name, and BU ID in your correspondence,

Institutional Loans

Boston University offers various institutional loans to eligible students. An applicant/student must be a U.S. citizen, a naturalized citizen of the United States, permanent resident or an eligible non-citizen. Financial aid is awarded on the basis of demonstrated need. Students are initially reviewed and considered for BU Loans during the financial aid application process. These loans are funded through generous gifts from Boston University Alumni and Friends. Students are notified of their eligibility for institutional loans by Student Financial Services as funding for all loans is limited.

- The interest rates range from 3% – 7% and may be fixed or variable and interest does not accrue or capitalize while you are in school.

- Students have a 10 year standard repayment plan.

- Repayment beings 12 months after you graduate or leave school. The amount is determined based on your calculated financial aid eligibility and the availability of funds.

- Click here to learn about the forbearance and deferment borrower benefits offered to students.